Name, Address and Age(1) | | | Position(s) Held with Company | | | Terms of Office and Length of Time Served | | | Principal Occupation(s) During the Past 5 Years | | | Other Directorships Held by Director or Nominee for Director During Past 5 Years | |

Cynthia Fryer Steer, | | | Independent Director and Chair of the Valuation Committee | | | Class I Director since July 2022; Term Expires 2024 |

| | Retired | | | Director and Chair, Mission Square Director, Xponance | |

Sachin Goel, 7Director—Director — Term Expiring in 2025

Company

Length of Time Served

During the Past 5 Years

Held by Director or

Nominee for Director

During Past 5 Years 42 Interested Director Class II Director since July 2022; Term Expires 2025 Managing Director at Brightwood Capital Advisors, LLC Director, Midwest Holding Inc.

Name, Address and Age(1) | | | Position(s) Held with Company | | | Terms of Office and Length of Time Served | | | Principal Occupation(s) During the Past 5 Years | | | Other Directorships Held by Director or Nominee for Director During Past 5 Years | |

Carol Moody, | | | Independent Director and Chairperson of the Audit Committee | | | Class II Director since July 2022; Term Expires 2025 | | | President and CEO of Legal Momentum | | | Director of Legal Momentum | |

We believe that Ms. Moody’s broad and extensive financial services experience supports her membership on our Board.–— The Women’s Legal Defense and Education Fund. Ms. Moody is formerly the Founder and Principal of CAB Moody, LLC and a Senior Portfolio Manager and Acting Chief Investment Officer for CalPERS. Prior to joining CalPERS, Ms. Moody held a series of senior risk and compliance roles and Wilmington Trust Company, Nationwide Insurance, TIAA-CREF, TCW/Latin American Partners, LLC and Citibank. Ms. Moody received her bachelor’s degree from The Wharton School at the University of Pennsylvania and her J.D. from Columbia University School of Law.8(1)The business address

Company

Length of Time Served

During the director nomineesPast 5 Years

Held by Director or

Nominee for Director

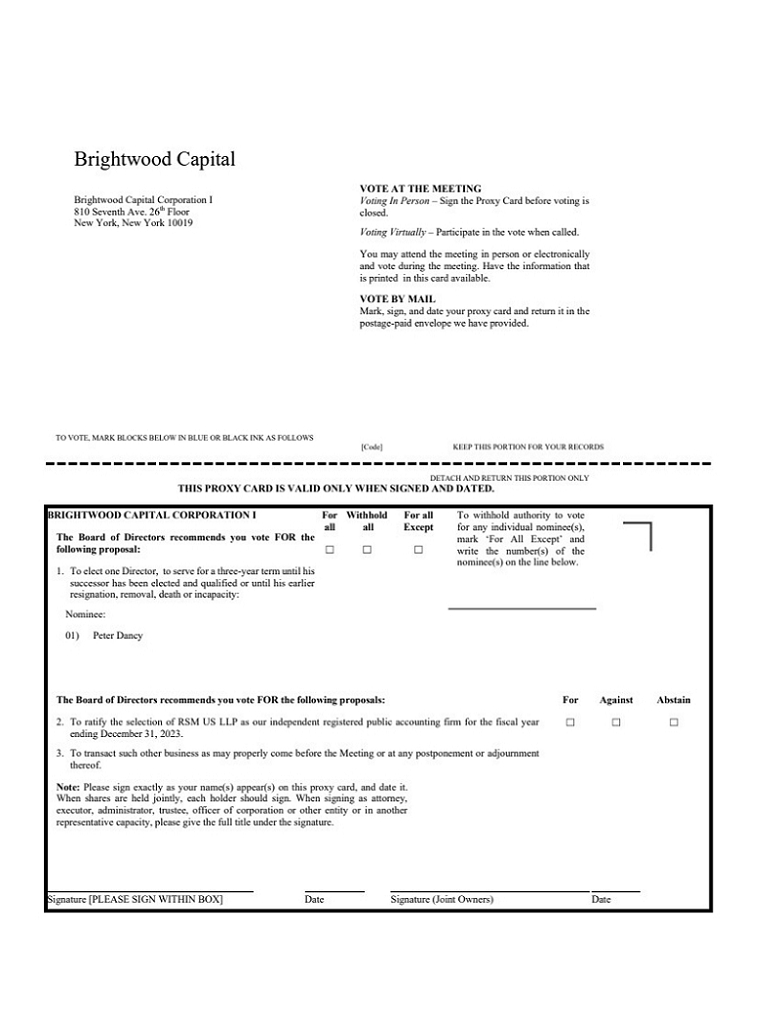

During Past 5 Years Peter Dancy, 59 Independent Director and other directors is c/o BrightwoodChair of Nominating and Corporate Governance Committee Class III Director since July 2022; Term Expires 2026 Corporation I, 810 Seventh Avenue, Floor 26, New York, New York 10019.Partners None

Name, Address and Age(1) | | | Position(s) Held with the Company | | | Principal Occupations(s) During the Past 5 Years | |

Darilyn T. Olidge, Esq., | | | Chief Compliance Officer since July 2022 | | | Partner, General Counsel and Chief Compliance Officer at Brightwood Capital Advisors, LLC | |

| Russell Zomback, 54 | | | Chief Financial Officer since July 2022 | | | Chief Financial Officer at Brightwood Capital Advisors, LLC | |

| Martina A. Brosnahan, Esq., | | | Secretary since July 2022 | | | Managing Director | |

Russell Zomback is Chief Financial Officer of Brightwood. Mr. Zomback was Brightwood’s first outside hire in April 2011. During his time at the firm, he has played a key role in driving Brightwood’s growth from its launch into a $4 billion direct lending platform, and he has led and managed the finance function for all of Brightwood’s funds. Prior to joining Brightwood in 2011, Mr. Zomback served as Executive Vice President of Finance at Golub Capital. Over twelve years at Golub, Mr. Zomback oversaw three SBIC partnerships, a number of other investment partnerships, and supported the firm’s expansion from $250 million to $4 billion in assets under management. Prior to Golub, Mr. Zomback was with Goldstein Golub Kessler as an audit manager in the financial services group. Mr. Zomback holds a bachelor’s degree in accounting from SUNY Binghamton.

Under our bylaws, our Board may designate one of our directors as chair to preside over meetings of our Board and meetings of stockholders and to perform such other duties as may be assigned to him or her by our Board.

Our Board also performs its risk oversight responsibilities with the assistance of our Chief Compliance Officer. Our Board receives a quarterly report from our Chief Compliance Officer, who reports on our compliance with the federal securities laws and our internal compliance policies and procedures as well as those of the Adviser, our administrator and our transfer agent. The Board also reviews annually a written report from the Chief Compliance Officer discussing, in detail, the adequacy and effectiveness of our compliance policies and procedures and those of our service providers.

2023.

Nominating and Corporate Governance Committee.

The members of the Nominating and Corporate Governance Committee are the independent directors. Mr. Dancy serves as Chair of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee operates pursuant to a charter approved by the Board, which sets forth the responsibilities of the Nominating and Corporate Governance Committee, a copy of which is attached to this Proxy Statement as Annex B. The Nominating and Corporate Governance Committee is responsible for selecting, researching and nominating directors for election by the Stockholders, selecting nominees to fill vacancies on the Board or a committee of the Board, developing and recommending to the Board a set of corporate governance principles and overseeing the evaluation of the Board and management.| Name | Fees Earned (1) | Stock Awards (2) | All Other Compensation | Total | ||||||||||

| Carol Moody | $ | — | — | $ | 50,000 | |||||||||

| Peter J. Dancy | $ | — | — | $ | 50,000 | |||||||||

| Cynthia Fryer Steer | $ | — | — | $ | 50,000 | |||||||||

| Name | | | Fees Earned(1) | | | Stock Awards(2) | | | All Other Compensation | | | Total | | ||||||||||||

| Carol Moody | | | | $ | 100,000 | | | | | | — | | | | | | — | | | | | $ | 100,000 | | |

| Peter J. Dancy | | | | $ | 100,000 | | | | | | — | | | | | | — | | | | | $ | 100,000 | | |

| Cynthia Fryer Steer | | | | $ | 100,000 | | | | | | — | | | | | | — | | | | | $ | 100,000 | | |

Under the Investment Advisory Agreement, the Company pays the Adviser (i) a base management fee and (ii) an incentive fee as compensation for the investment advisory and management services it provides the Company thereunder.

For the year ended December 31, 2022,2023, the Company incurred $650,875$776,639 in expenses under the Administration Agreement which were recorded in administrative service expenses in the Consolidated Statements of Operations included in the Annual Report on Form 10-K for the year ended December 31, 2022,2023, as filed with the SEC.

OF RSM US LLP AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE

| Service | For the Period September 26, 2022 (commencement of operations) through December 31, 2022 | |||

| Audit Fees | $ | 270,900 | ||

| Audit Related Fees | - | |||

| Tax Fees | - | |||

| All Other Fees | - | |||

| Total | $ | 270,900 | ||

2023:

| Service | | | For the Period September 26, 2022 (commencement of operations) through December 31, 2022 | | | For the fiscal year ended December 31, 2023 | | ||||||

| Audit Fees | | | | $ | 270,900 | | | | | $ | 424,666 | | |

| Audit Related Fees | | | | | — | | | | | | | | |

| Tax Fees | | | | | — | | | | | $ | 17,325 | | |

| Other Fees | | | | | — | | | | | | | | |

| Total | | | | $ | 270,900 | | | | | $ | 441,991 | | |

Tax Fees

Based on the Audit Committee’s review and discussions with management and the independent registered public accounting firm referred to above, the Audit Committee’s review of the Company’s audited financial statements, the representations of management and the report of RSM to the Audit Committee, the Audit Committee recommended to the Board that the audited financial statements as of and for the year ended December 31, 20222023 be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022,2023, for filing with the SEC. The Audit Committee also recommended the appointment of RSM to serve as the independent registered public accounting firm of the Company for the year ending December 31, 2023.

2024.

Carol Moody (Chair)

Peter J. Dancy

Cynthia Fryer Steer

The

2024.

The Company reserves the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements. Please refer to our bylaws for more information regarding the information required to be included in a stockholder’s notice.

Chairperson

April

BRIGHTWOOD CAPITAL CORPORATION I

AUDIT COMMITTEE CHARTER

III. Authority

1 For purposes of this Charter, the term “management” means the appropriate officers of the Company, and its investment adviser, administrator, fund accounting agent and other key service providers (other than the independent accountants). Also, for purposes of this Charter, the phrase “internal accounting staff” means the appropriate officers and employees of the Company, and its investment adviser, administrator, fund accounting agent and other key service providers (other than the independent accountants).

IV. Responsibilities

1. to appoint and retain each year a firm or firms of independent accountants to audit the accounts and records of the Company, to approve the terms of compensation of such independent accountants and to terminate such independent accountants as it deems appropriate; 2. to pre-approve the engagement of the independent accountants to render audit and/or permissible non-audit services (including the fees charged and proposed to be charged by the independent accountants), subject to the de minimisexceptions under Section 10A(i)(1)(B) of the Exchange Act, and as otherwise required by law;2 |

Oversight of the Company’s Relationship with the Independent Accountants

A majority, but not less than two, of the members of the Audit Committee shall be present at any meeting of the Audit Committee in order to constitute a quorum for the transaction of business at such meeting, and the act of a majority present shall be the act of the Audit Committee.

BRIGHTWOOD CAPITAL CORPORATION I

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE CHARTER

account. If held in joint tenancy, all persons should sign. Trustees, administrators,

Committee.

Pursuant to authority granted to it by the Board of Directors, the responsibilities of the Nominating and Corporate Governance Committee are as follows:

6. The Nominating and Corporate Governance Committee shall, upon a significant change in a member of the Board of Directors’ personal circumstances (including a change in principal occupation) or in the event a significant ongoing time commitment arises that may be inconsistent with a member of the Board of Director’s service to the Board of Directors, review, as appropriate, the continued membership of such member on the Board of Directors.

V. Meetings

![[MISSING IMAGE: px_24brightwooproxy1pg01-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045843/px_24brightwooproxy1pg01-bw.jpg)

![[MISSING IMAGE: px_24brightwooproxy1pg02-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-045843/px_24brightwooproxy1pg02-bw.jpg)